Alpha对冲策略

1. 策略原理

何为alpha?

提到Alpha策略,首先要理解什么是CAPM模型。

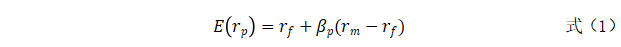

CAPM模型于1964年被Willian Sharpe等人提出。Sharpe等人认为,假设市场是均衡的,资产的预期超额收益率就由市场收益超额收益和风险暴露决定的。如下式所示。

其中rm为市场组合,rf为无风险收益率。

根据CAPM模型可知,投资组合的预期收益由两部分组成,一部分为无风险收益率rf,另一部分为风险收益率。

CAPM模型一经推出就受到了市场的追捧。但在应用过程中发现,CAPM模型表示的是在均衡状态下市场的情况,但市场并不总是处于均衡状态,个股总会获得超出市场基准水平的收益,即在CAPM模型的右端总是存在一个alpha项。

为了解决这个问题,1968年,美国经济学家迈克·詹森(Michael Jensen)提出了詹森指数来描述这个alpha,因此又称alpha指数。计算方式如式2所示。

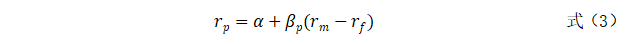

因此,投资组合的收益可以改写成

可将投资组合的收益拆分为alpha收益和beta收益。其中beta的计算公式为

β是由市场决定的,属于系统性风险,与投资者管理能力无关,只与投资组合与市场的关系有关。当市场整体下跌时,β对应的收益也会随着下跌(假设beta为正)。alpha收益与市场无关,是投资者自身能力的体现。投资者通过自身的经验进行选股择时,得到超过市场的收益。

什么是alpha对冲策略?

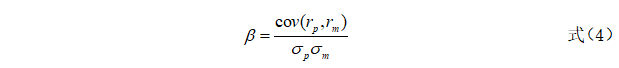

所谓的alpha对冲不是将alpha收益对冲掉,恰恰相反,alpha对冲策略是将β收益对冲掉,只获取alpha收益,如下图所示。

alpha对冲策略将市场性风险对冲掉,只剩下alpha收益,整体收益完全取决于投资者自身的能力水平,与市场无关。目前,有许多私募基金采用alpha对冲策略。

怎么对冲?

alpha对冲策略常采用股指期货做对冲。在股票市场上做多头,在期货市场上做股指期货空头。当股票现货市场亏损时,可以通过期货市场弥补亏损;当期货市场亏损时,可以通过股票现货市场弥补亏损。

策略收益情况

目前alpha对冲策略主要用于各类基金中。国际上比较知名的桥水基金、AQR基金等都采用过这种策略。国内也有许多利用alpha对冲策略的基金,比如海富通阿尔法对冲混合、华宝量化对冲混合等,近一年平均收益率约为36.70%。

策略要点

alpha策略能否成功,主要包括以下几个要点

- 获取到的alpha收益是否足够高,能否超过无风险利率以及指数.

- 期货和现货之间的基差变化.

- 期货合约的选择.

alpha对冲只是一种对冲市场风险的方法,在创建策略时需要结合其他理论一起使用,怎样获取到较高的alpha收益才是决定策略整体收益的关键。

2. 策略实现

第一步:制定一个选股策略,构建投资组合,使其同时拥有alpha和beta收益。

(本策略选取过去一天EV/EBITDA值并选取30只EV/EBITDA值最小且大于零的股票)

第二步:做空股指期货,将投资组合的beta抵消,只剩alpha部分。

第三步:进行回测。

股票池:沪深300指数

期货标的:CFFEX.IF对应的真实合约

回测时间:2017-07-01 08:00:00 至 2017-10-01 16:00:00

回测初始资金:1000万

3. 策略代码

# coding=utf-8from __future__ import print_function, absolute_import, unicode_literalsfrom gm.api import *'''本策略每隔1个月定时触发计算SHSE.000300成份股的过去一天EV/EBITDA值并选取30只EV/EBITDA值最小且大于零的股票对不在股票池的股票平仓并等权配置股票池的标的并用相应的CFFEX.IF对应的真实合约等额对冲回测数据为:SHSE.000300和他们的成份股和CFFEX.IF对应的真实合约回测时间为:2017-07-01 08:00:00到2017-10-01 16:00:00注意:本策略仅供参考,实际使用中要考虑到期货和股票处于两个不同的账户,需要人为的保证两个账户的资金相同。'''def init(context):# 每月第一个交易日09:40:00的定时执行algo任务(仿真和实盘时不支持该频率)schedule(schedule_func=algo, date_rule='1m', time_rule='09:40:00')# 设置开仓在股票和期货的资金百分比(期货在后面自动进行杠杆相关的调整)context.percentage_stock = 0.4context.percentage_futures = 0.4def algo(context):# 获取当前时刻now = context.now# 获取上一个交易日last_day = get_previous_trading_date(exchange='SHSE', date=now)# 获取沪深300成份股的股票代码stock300 = get_history_constituents(index='SHSE.000300', start_date=last_day,end_date=last_day)[0]['constituents'].keys()# 获取上一个工作日的CFFEX.IF对应的合约index_futures = get_continuous_contracts(csymbol='CFFEX.IF', start_date=last_day, end_date=last_day)[-1]['symbol']# 获取当天有交易的股票not_suspended_info = get_history_instruments(symbols=stock300, start_date=now, end_date=now)not_suspended_symbols = [item['symbol'] for item in not_suspended_info if not item['is_suspended']]# 获取成份股EV/EBITDA大于0并为最小的30个fin = get_fundamentals(table='trading_derivative_indicator', symbols=not_suspended_symbols,start_date=now, end_date=now, fields='EVEBITDA',filter='EVEBITDA>0', order_by='EVEBITDA', limit=30, df=True)fin.index = fin.symbol# 获取当前仓位positions = context.account().positions()# 平不在标的池或不为当前股指期货主力合约对应真实合约的标的for position in positions:symbol = position['symbol']sec_type = get_instrumentinfos(symbols=symbol)[0]['sec_type']# 若类型为期货且不在标的池则平仓if sec_type == SEC_TYPE_FUTURE and symbol != index_futures:order_target_percent(symbol=symbol, percent=0, order_type=OrderType_Market,position_side=PositionSide_Short)print('市价单平不在标的池的', symbol)elif symbol not in fin.index:order_target_percent(symbol=symbol, percent=0, order_type=OrderType_Market,position_side=PositionSide_Long)print('市价单平不在标的池的', symbol)# 获取股票的权重percent = context.percentage_stock / len(fin.index)# 买在标的池中的股票for symbol in fin.index:order_target_percent(symbol=symbol, percent=percent, order_type=OrderType_Market,position_side=PositionSide_Long)print(symbol, '以市价单调多仓到仓位', percent)# 获取股指期货的保证金比率ratio = get_history_instruments(symbols=index_futures, start_date=last_day, end_date=last_day)[0]['margin_ratio']# 更新股指期货的权重percent = context.percentage_futures * ratio# 买入股指期货对冲# 注意:股指期货的percent参数是按照期货的保证金来算比例,不是按照合约价值, 比如说0.1就是用0.1的仓位的资金全部买入期货。order_target_percent(symbol=index_futures, percent=percent, order_type=OrderType_Market,position_side=PositionSide_Short)print(index_futures, '以市价单调空仓到仓位', percent)if __name__ == '__main__':'''strategy_id策略ID,由系统生成filename文件名,请与本文件名保持一致mode实时模式:MODE_LIVE回测模式:MODE_BACKTESTtoken绑定计算机的ID,可在系统设置-密钥管理中生成backtest_start_time回测开始时间backtest_end_time回测结束时间backtest_adjust股票复权方式不复权:ADJUST_NONE前复权:ADJUST_PREV后复权:ADJUST_POSTbacktest_initial_cash回测初始资金backtest_commission_ratio回测佣金比例backtest_slippage_ratio回测滑点比例'''run(strategy_id='strategy_id',filename='main.py',mode=MODE_BACKTEST,token='token_id',backtest_start_time='2017-07-01 08:00:00',backtest_end_time='2017-10-01 16:00:00',backtest_adjust=ADJUST_PREV,backtest_initial_cash=10000000,backtest_commission_ratio=0.0001,backtest_slippage_ratio=0.0001)

4. 回测结果与稳健性分析

设定初始资金1000万,手续费率为0.01%,滑点比率为0.01%。策略回测结果如下图所示。

回测期累计收益率为0.32%,年化收益率为1.32%,沪深300指数收益率为5.09%,策略整体跑输指数。最大回撤为1.17%,胜率为74.29%。

以同样的策略进行选股,不对冲beta时回测结果如下图所示。

对比可以看出,利用alpha对冲策略比未对冲策略收益低,但胜率高于普通策略,最大回撤低于未对冲策略。这也说明了alpha对冲策略能够规避一部分由市场带来的风险。

改变回测期,观察策略收益情况如下表所示(以2020年10月30日为结束期)。

| 指标 | 近三月 | 近六月 | 今年来 | 近1年 | 近2年 | 近3年 |

|---|---|---|---|---|---|---|

| 年化收益率 | -3.72% | 7.11% | -2.26% | -0.77% | -0.52% | -3.05% |

| 最大回撤 | 3.14% | 3.09% | 7.88% | 7.86% | 14.72% | 16.12% |

| 胜率 | 86.96% | 90.00% | 42.96% | 64.36% | 60.48% | 50.55% |

由上表可知,近几年该策略的整体收益为负,只有近六月的收益率为正。策略最大回撤一直维持在相对较低的水平上,随着时间周期拉长,最大回撤不断增加,胜率不断下降。

注:此策略只用于学习、交流、演示,不构成任何投资建议。